CustomerZone online help

Manage your home loan via web browser

or our new mobile app!

You can manage your home loan in the way that suits you, whether that’s using the online CustomerZone portal or via our new Resimac NZ app! Features and benefits available on both platforms include: a responsive and user-friendly experience; Pay Anyone functionality; support for one-off, scheduled and recurring payments; enhanced fraud protection security; and on-demand e-statements and transaction history.

Download the free Resimac NZ app now:

Download the free Resimac NZ app now:

Manage your home loan via web browser

or our new mobile app!

Check out our new Resimac NZ app!

Introducing CustomerZone

CustomerZone is Resimac’s new online loan management platform where customers can manage their home loan, their way. New features and benefits offered by CustomerZone include: a responsive and user-friendly digital experience; Pay Anyone functionality; support for one-off, scheduled and recurring payments; enhanced fraud protection security; and on-demand e-statements and transaction history.

- Read about features and benefits of CustomerZone

- CustomerZone login

- Don’t know your Customer ID or password?

- Get help to getting started

- Get help in accessing redraw funds or transferring to external accounts

Introducing CustomerZone

Help and FAQs

Got any questions about CustomerZone? Our comprehensive FAQ below has answers to all of the most common questions. If your enquiry is not addressed in the FAQ, please send us an email at questions@resimac.co.nz, and we will reply as soon as possible. For urgent enquiries, please put “URGENT” in the email subject.Note: we are currently experiencing longer than normal wait times, so if you wish to speak to someone on the phone, you can avoid waiting on hold for an extended period by requesting a callback.

To begin, select the platform you need assistance with.

-

Resimac NZ app

-

CustomerZone website portal

-

Login process for existing Loan Enquiry user

- Open the Resimac NZ app and select ‘Get started’.

- Select ‘Registered user login’

- Enter your Loan Enquiry Channel ID and password.

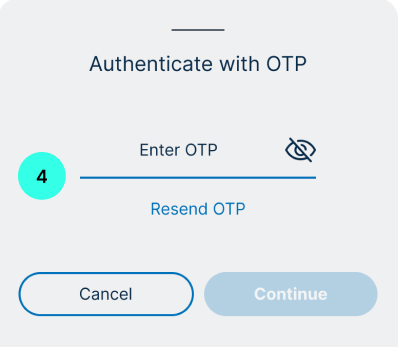

- Enter the OTP sent via text message and then create a 4-digit pin code.

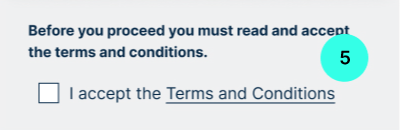

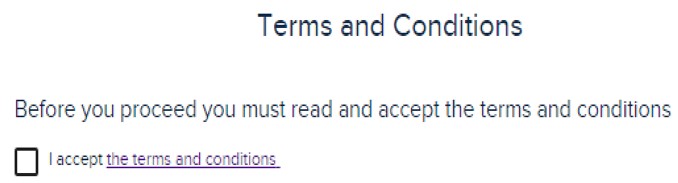

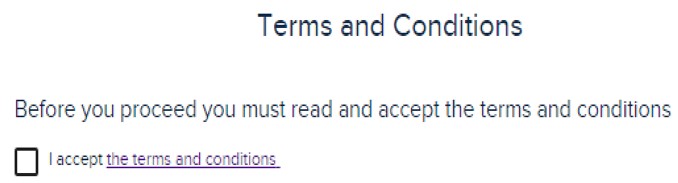

- Read and accept the terms and conditions.

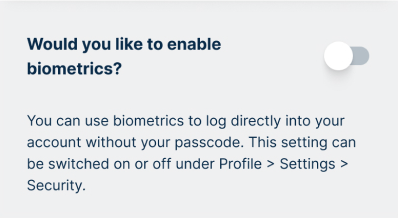

- Select to enable or disable biometrics.

- Open the Resimac NZ app and select ‘Get started’.

-

Registration process for new customers of CustomerZone

- Open the Resimac NZ app and select ‘Get started’.

- Find your Customer ID (CIF) on your settlement letter. If you can’t locate this, contact Customer Relations for help.

Select ‘New user registration’

- Enter your CIF ID and date of birth.

- Set a password, security questions.

IMPORTANT: Password are case sensitive. These should not contain any personally identifiable information (It is important that you do not use numbers that represent part of your birthday, telephone number or street address. Otherwise you may be liable for unauthorised transactions). - You will receive a One Time Passcode for identity verification.

- Log in with the new password and accept terms and conditions.

- Open the Resimac NZ app and select ‘Get started’.

-

I have forgotten my password

How to reset your password

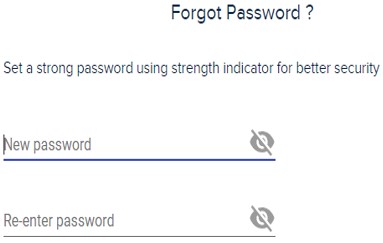

- To reset your password, click the forgotten password link at the login screen.

- This link will take you to the CustomerZone website.

- Enter your user ID and select continue.

- You will then need to enter your date of birth and a One Time Passcode received via text message.

- You will then be required to enter your new password.

- To reset your password, click the forgotten password link at the login screen.

-

How do I get assistance with my Customer ID (CIF)?

- You can find your CIF on your settlement letter. If you can’t locate this, contact Customer Relations for help.

-

What is Pay Anyone?‘Pay Anyone’ is a simple and convenient way to transfer money from your Resimac account to someone else’s account. It is supported by all financial institutions in New Zealand, including banks, and credit unions. All you need to transfer money using the CustomerZone Pay Anyone feature is the intended recipient’s BSB, Account number and the account name.

-

Can I transfer funds overseas using the Pay Anyone feature?Transferring funds overseas using Pay Anyone is not supported.

-

Are there any daily limits?

The following transfer limits apply:

Description Daily maximum limit Resimac accounts $20,000 Pay Anyone transaction $20,000 Loan Access Card $5,000 Loan Access Card (Cash withdrawals) $1,000 -

What if my Pay Anyone transaction can’t be processed?If your Pay Anyone transaction cannot be processed, you will receive an error message.

-

Can I modify or stop a Pay Anyone payment that is scheduled for today?You cannot modify or stop a Pay Anyone payment on the actual day that it is scheduled.

You can only modify payments that are scheduled for a future date. -

Can I stop a recurring Pay Anyone payment?Yes, you can delete, modify, or view details for a future payment for a recurring transaction.

To stop a recurring payment, you will need to stop the existing recurring payment series by selecting the recurring payment and click ‘STOP’. -

If I enter the wrong details for a payment, can I cancel the transaction and get my money back after the transaction has been processed?If your payment has already been processed, and you think you may have entered the incorrect payment details, you can verify the information by clicking on the ‘Past Payments’ tab on the Pay menu screen.

If the information is incorrect, you can log an online request for a mistaken payment.

Alternatively, you may contact our friendly Customer Relations team who should be able to assist you.

IMPORTANT: It may take up to 8-10 weeks for the resolution of a Pay Anyone dispute. This is because we will need to raise an ‘Mistaken Internet Payment’ (MIP) dispute on your behalf and work with external financial institutions in order to investigate the payment. -

How long will it take for someone to receive the funds I sent them via Pay Anyone?The time it takes for payees to see the funds in their bank account will vary depending on the policy and systems of the payee's bank/financial institution.

Generally, the payee should receive the funds within 24 to 48 hours. -

How do I manage my Payee list?

How to manage your Payee list

- Add, modify, or delete payees within Resimac NZ app under 'My Payees.'

You will need to authorise the changes with a One Time Passcode.

- Select Payments.

- Select My Payees.

- Add, modify, or delete payees within Resimac NZ app under 'My Payees.'

-

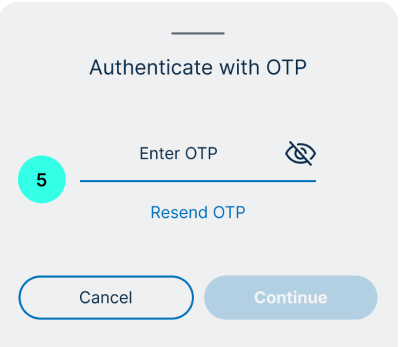

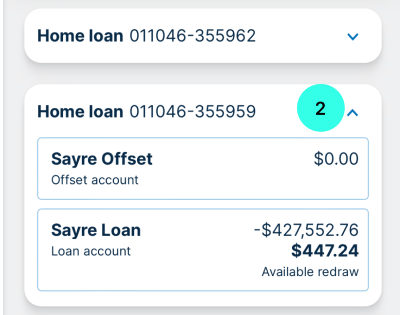

How do I obtain my statements?

How to get your statements

- You can obtain your online statement by selecting the ‘accounts’.

- Select the account you want to view statements for.

- Click on "Manage".

- Select "View statement".

- You can obtain your online statement by selecting the ‘accounts’.

-

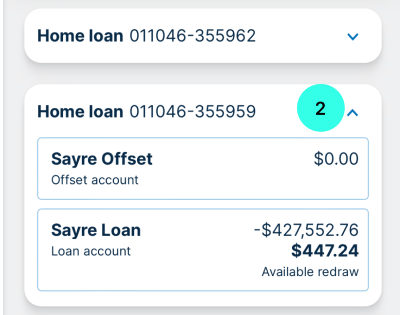

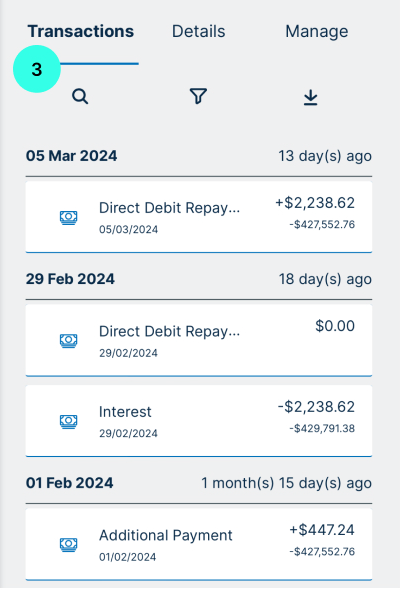

How can I view my transaction history of my account?

How to view your transaction history

- You can view your transaction listing by selecting ‘accounts’.

- Select the account you want to view transactions for.

- Click on "Transactions".

- By clicking on the ‘filter button’, you can use the filter and change the dates to view your transaction in the past 13 months.

- You can also download the transaction listing as a PDF or as an excel

- You can view your transaction listing by selecting ‘accounts’.

-

Can I switch to e-statements in the Resimac NZ app?To switch to eStatements you can submit a request by clicking on the ‘Service Requests’ icon in the Resimac NZ app or by contacting our friendly Customer Relations team who will be able to assist you.

-

I received an email about changes to my Resimac NZ app log-in. Is this legitimate?Yes. We’re making changes to the Resimac NZ app to make it easier for you to manage your home loans online.

This upgrade is being rolled out to customers progressively, and we’ll send you an email confirmation as soon as the change is made to your online account. -

Can I make extra payments to my loan account?Yes, within the Resimac NZ app, you will be able to transfer between your accounts.

Or alternatively, you can set up extra payments from your external bank account to credit your loan account -

Can I change my repayment frequency and amount?Yes, you can change your repayment frequency from weekly, fortnightly, or monthly for all Principal and Interest (P&I).

Note, if your account is Interest Only (IO) your repayments can only be monthly.

Please contact the Resimac Customer Relations team on 0800 38 48 58 or email customerassist@resimac.co.nz who will be able to assist you with changing your repayment frequency. -

How to change my external nominated account details?

- You cannot change or update the nominated repayment account details in the Resimac NZ app.

- To do this, you will first need to complete a Direct Debit form signed by all loan parties.

- To begin the process, please start by downloading the ‘Direct Debit Request form’ here and complete all the required fields.

- Along with the completed form, we will also require proof of account details, and confirmation from all parties. This can be satisfied with the following information:

- A copy of a Bank Statement of the new account, showing the account name, BSB and account number. If the account is new and a bank statement is not yet available, please provide a letter from the bank, on bank letterhead showing the account name, BSB and account number.

- If the new account is in the name of a company, we require proof that one or both borrowers are directors of the company.

- If the new account is a joint account but the co-account holder is not a borrower on the loan, we will require the co-account holder (non-borrower) to also sign the direct debit authority as well as provide photo ID showing a clear signature for verification purposes.

- Please note, if a statement or letter from the bank is not attached the request will not be processed. Third party accounts are not acceptable.

- Once all information is completed and signed by all parties, please email all documents to customerassist@resimac.co.nz

-

Can I update my mobile number and email address in the Resimac NZ app?No. You can submit a request by clicking on the ‘Service Requests’ icon in the Resimac NZ app or contact our friendly Customer Relations team who will verify your identity before updating your mobile number and email address.

-

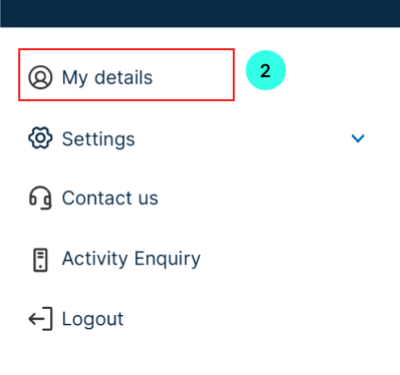

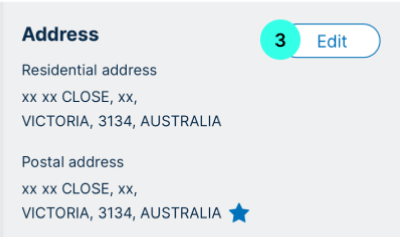

Can I update my address in the Resimac NZ app?

How to update your address

- Open the "Profile" menu

- Click on "My Details"

- You can edit your mailing address and residential address by clicking on the "Edit my address" link:

- Open the "Profile" menu

-

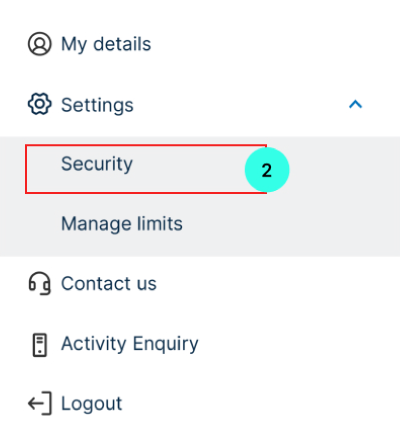

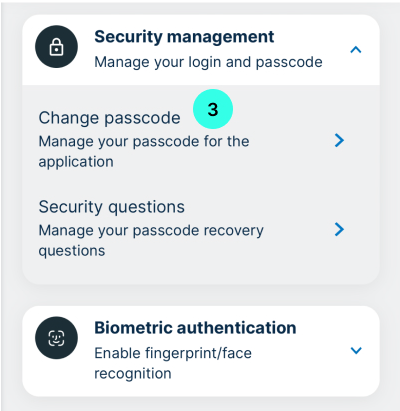

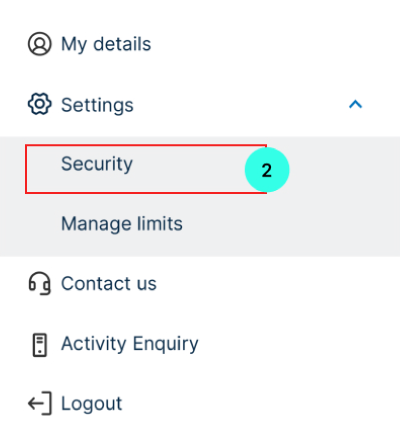

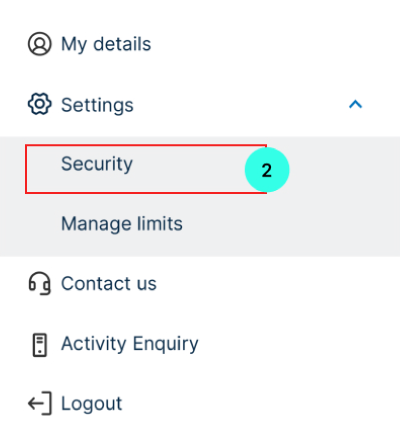

Can I change my passcode?Yes, you can change your passcode within ‘Settings’.

- First select "Profile"

- Select "Settings" then "Security" from it's sub-menu.

- Select "Change Passcode"

- First select "Profile"

-

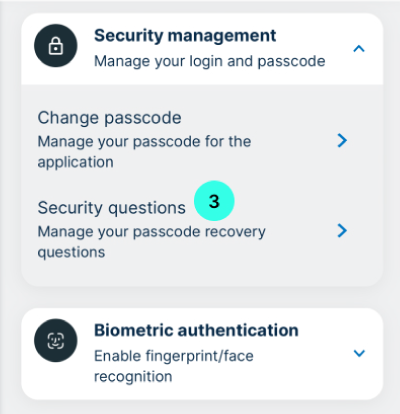

Can I change my security questions?Yes, you can change your security questions within ‘Settings’.

- First select "Profile"

- Select "Settings" then "Security" from it's sub-menu.

- Select "Security questions"

- First select "Profile"

-

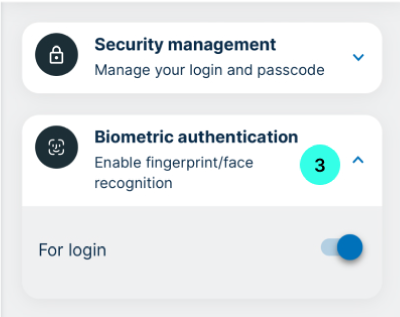

Is enabling biometrics optional, and how can I do it?Enabling biometrics is optional; follow in-app prompts.

- First select "Profile"

- Select "Settings" then "Security" from it's sub-menu.

- Select "Biometric authentication" then toggle on "For login" from it's sub-menu.

- First select "Profile"

-

How to fully discharge or refinance your loan?

- To complete a full discharge, refinance or make amendments to your loan, you will need to contact the Customer Relations team.

Please note: There may be fees associated with the discharging of your loan, which will be outlined by the Discharges team after reviewing your loan and documentation.

- To complete a full discharge, refinance or make amendments to your loan, you will need to contact the Customer Relations team.

-

What happens to my Resimac NZ app access when I fully discharge my loan?You will no longer have access to the Resimac NZ app once you have fully discharged your loan.

-

Accessing available redraw and transferring funds between accounts?

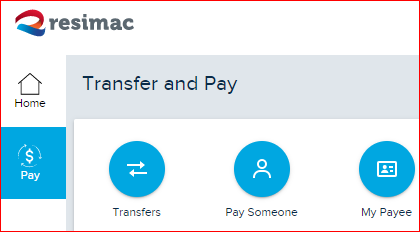

Yes you can access your available redraw and either transfer between your accounts or pay someone from the ‘Transfer and Pay’ screen:

- Select "Payments" menu

- Select "Transfers"

- Select "Payments" menu

-

Secure log in and access process

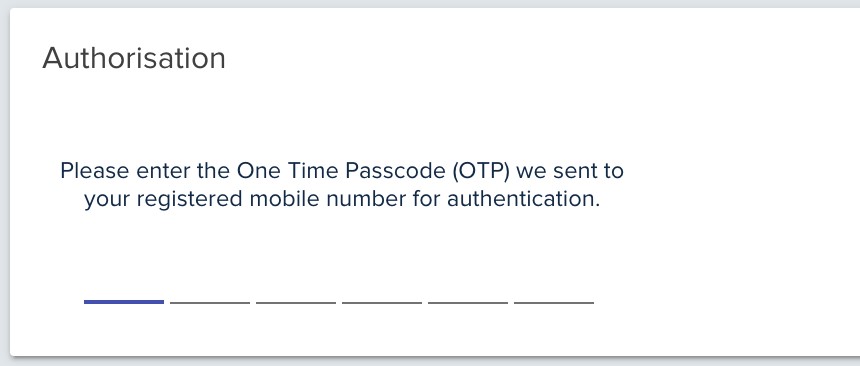

- We require the setup of a complex password, and for you to keep it a secret. Multiple attempts with an incorrect password will result in a lock out of your account, to prevent brute force attacks.

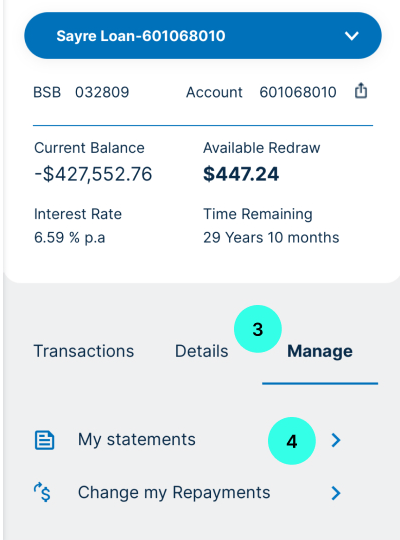

- We rely on a One-Time Passcode (OTP) for major transactions and system changes. For your safety, multiple incorrect attempts at entering your passcode will also result in the account being locked out.

- We send you alerts on major activities in your account – e.g. registration, password resets etc – so you have visibility if a change has occurred. Please contact us urgently if you receive an alert indicating a change that you (or your joint account holder) has not initiated.

- We limit the transactions that can be done online so that the risk of fraud is limited (Refer to “Payments > Are there daily limits” for more information).

-

What is a One-Time Passcode (OTP)?

- An OTP is an automatically generated number that authenticates a user for a single transaction or session. These codes are sent to your registered mobile phone number, and provides an additional layer of security.

- We rely on OTPs delivered to you to verify major transactions and system changes.

- For your safety, multiple incorrect attempts at entering your passcode will result in the account being locked out.

-

Why aren’t I receiving one-time passcodes via email anymore?We will only be using SMS, and not email, to send you one-time passcodes to help use your online loan management platform. You may need to consider this before you next travel overseas.

-

What if I still find myself unable to receive SMS overseas and need access to my account?You can contact our friendly Customer Care team or call us on 1300 764 447 (9am to 5pm AEST) for assistance.

-

Additional security featuresRoutine independent security reviews

- We routinely request 3rd party independent reviews and testing on the security of our platform.

- We have 24/7 application monitoring in place to detect suspicious behaviour on our platform

- When you provide information on our platform we use a process of encryption to make your data unreadable to a fraudster who tries to infiltrate the platform.

- For some complex transactions, you may be required to phone our call centre.

-

What devices will the app work on?The app will work on compatible Apple devices (iOS 13 and above) and Android devices (version 9 and above).

-

How do I make sure I have the latest version of the app?We’re constantly updating our app to release new features and bug fixes. To make sure you have the latest version of the app, we recommend you choose automatic app updates if this option is available on your device.

-

How do I download the Resimac NZ app?You can download the Resimac NZ app from either the App store or Google play store.

-

Can I install the Resimac NZ app on more than one device?Yes. You can register the app on multiple devices, including a combination of both Android and iOS devices. .

-

How do I create a passcode?Select four digits that you'll remember. For security reasons, we will not accept consecutive numbers like 1234, or repeated numbers such as 0000.

-

What happens if I enter my passcode incorrectly?If you have forgotten your passcode, you can follow the "Forgot my passcode" link on the screen. You will have three attempts to enter the correct passcode when accessing the app. After three unsuccessful attempts, your app will be locked. You will need to contact us on 1800 111 001 to unlock your app.

-

How do I set up fingerprint or FaceID (biometrics) security?When you use the app for the first time, you'll be prompted to set-up biometrics, if you choose to do so at a later time, visit 'Menu', then 'Settings', 'Security' then 'Biometric authentication'. Please note that FaceID is only available for iOS at this stage. For Android, we only support fingerprint biometrics.

-

What information does the app store on my phone?The app does not store any data on your phone except for your member and in-app preferences such as quick balance.

-

Does the app require a Wi-Fi connection?No, the app will perform all functions on either a WIFI or mobile data connection. The processing times will vary according to your connection.

-

What do I do if I lose my phone or my phone is stolen?Contact us on 1300 764 447. You can also manage your account via CustomerZone on your web browser. Select ‘Manage Cards’ option from the ‘Accounts’ screen, and then select ‘Report Lost or Stolen Card’. This will cause all transactions attempted on the card to be declined, including any recurring payments, balance updates and transfers performed via the app.

-

How do I get push notifications?The app does not support push notification functionality yet.

-

How do I register a travel notification via the app?We do not support this within the app yet. But if you are travelling you can let us know us by calling us on 1300 764 447.

-

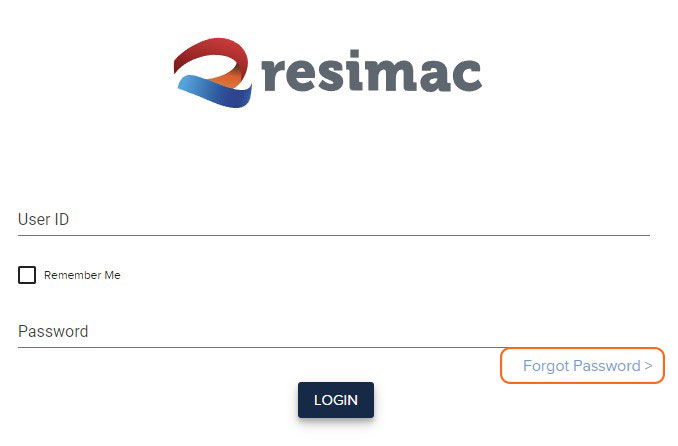

What is the registration process for existing Loan Enquiry customers and new customers for CustomerZone, Resimac’s online access platform?

Login process for existing Loan Enquiry users

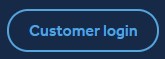

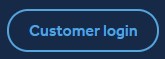

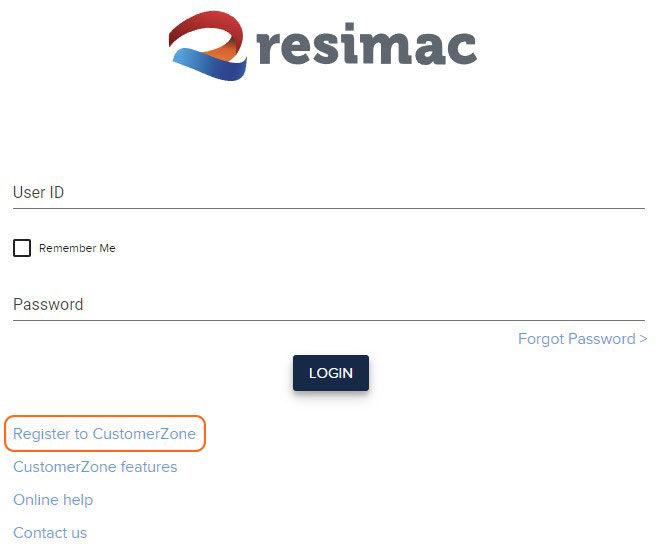

- To log onto CustomerZone, visit the Resimac Home Loans homepage www.resimac.co.nz.

- From the homepage click on ‘Login’ top right-hand corner.

- Then click on ‘Customer login’

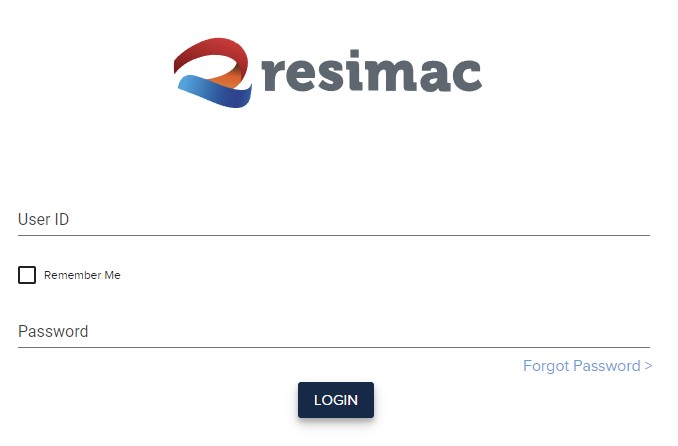

This will direct you to the CustomerZone customer login page.

This will direct you to the CustomerZone customer login page.

- Your username will be the same Customer ID that you use to log into Loan Enquiry.

- Your password will also be the same password that you currently use to log into Loan Enquiry.

- The first time you login, you will be prompted to change your password and follow the prompts.

- Read and accept the terms and conditions for CustomerZone.

- Following this, you will be prompted to answer your security questions, these are the ones you chose when you registered for loan enquiry.

Register as a new user

- To register as a new user on CustomerZone, visit the Resimac Home Loans homepage www.resimac.co.nz.

- From the homepage click on ‘Login’ top right-hand corner.

- Then click on ‘Customer login’

This will direct you to the CustomerZone customer login page.

This will direct you to the CustomerZone customer login page.

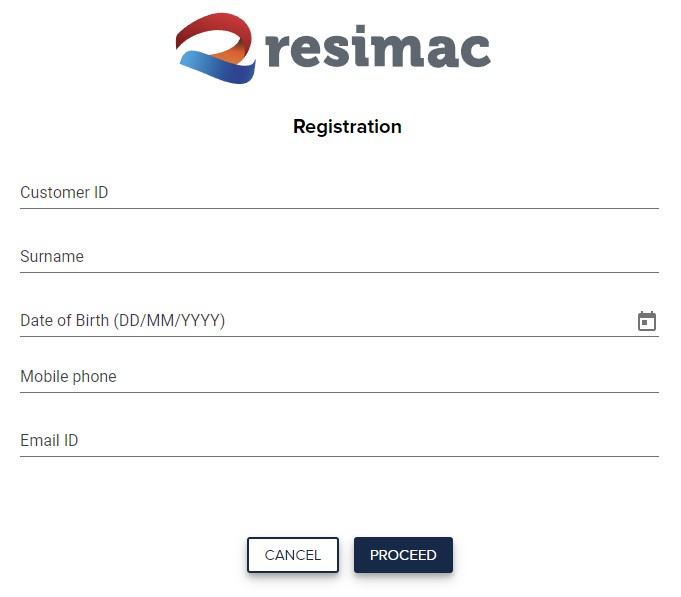

- Click on ‘Register to CustomerZone’ and follow the prompts.

- As part of the registration process you will be prompted to complete an online form with your personal details. The information is to help us validate your information.

- IMPORTANT: In order to register you will first need to contact the Resimac Customer Relations team on 0800 38 48 58 or email customerassist@resimac.co.nz who will be able to assist you obtain your Customer ID.

- Once we have successfully your information, you will also be asked to create a password and set some security questions, which will be used to help identify you as an additional layer of security.

- Protecting your identity is important to us. For security purposes, we will send you a One Time Passcode to the registered mobile number.

- You will then be returned to the login page where you can login into your new account. Your User ID will be the customer ID you provided on the registration page.

- The first time you login, you will be prompted to read and accept the terms and conditions for CustomerZone.

-

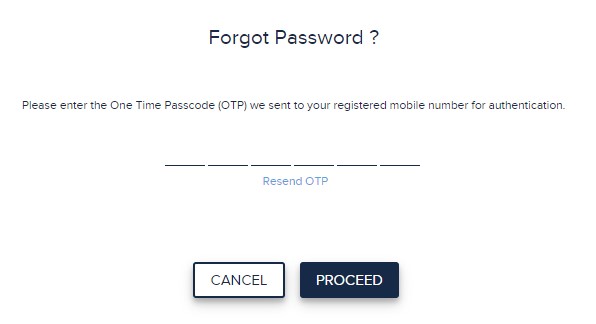

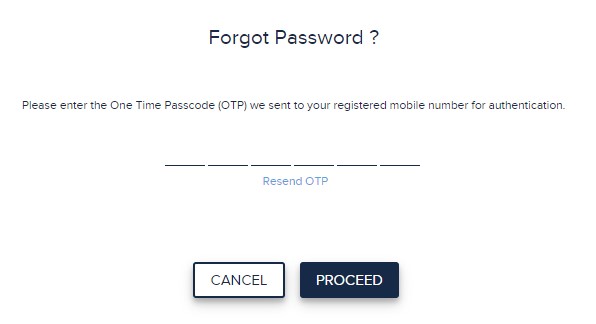

I have forgotten my password

How to reset your password

- If you have forgotten your password, you can reset your password from the CustomerZone login page.

- Enter your Username and click ‘Forgot Password’.

- You will be sent a One Time Passcode (OTP) to your registered mobile number.

- Enter the code that was sent to your registered mobile phone. From there you will be prompted to answer the security questions and click proceed.

- You will be prompted to set a strong password using the strength indicator.

IMPORTANT: Passwords are case sensitive. For your added protection, we do not support the copy and paste function from third party password managers as we cannot guarantee they are secure.

IMPORTANT: Passwords are case sensitive. For your added protection, we do not support the copy and paste function from third party password managers as we cannot guarantee they are secure. - After setting your new password and confirming it, you will be returned to the homepage.

- You can log into your account with your userID and the new password you have reset.

-

I don't know my Customer ID

How to retrieve your Customer ID

- If you don’t know your Customer ID, please contact the Resimac Customer Relations team on 0800 38 48 58 or email customerassist@resimac.co.nz who will be able to assist you.

-

What is Pay Anyone?‘Pay Anyone’ is a simple and convenient way to transfer money from your Resimac account to someone else’s account. It is supported by all financial institutions in New Zealand, including banks, and credit unions. All you need to transfer money using the CustomerZone Pay Anyone feature is the intended recipient’s BSB, Account number and the account name.

-

Can I transfer funds overseas using the Pay Anyone feature?Transferring funds overseas using Pay Anyone is not supported.

-

Are there any daily limits?

The following transfer limits apply:

Description Daily maximum limit Resimac accounts $20,000 Pay Anyone transaction $20,000 Loan Access Card $5,000 Loan Access Card (Cash withdrawals) $1,000 -

What if my Pay Anyone transaction can’t be processed?If your Pay Anyone transaction cannot be processed, you will receive an error message with the reason.

-

Can I modify or cancel/delete a Pay Anyone payment that is scheduled for today?You cannot modify or cancel/delete a Pay Anyone payment that is scheduled for today.

You can only modify payments that are scheduled for a future date. -

Can I stop a recurring Pay Anyone payment?Yes, you can delete, modify, or view details for a future payment for a recurring transaction.

To stop a recurring payment, you will need to delete the existing recurring payment series by selecting the recurring payment you wish to delete and click delete. -

If I enter the wrong details for a payment, can I cancel the transaction and get my money back after the transaction has been processed?If your payment has already been processed, and you think you may have entered the incorrect payment details, you can enquire about a past funds transfer for a Pay Anyone payment by viewing the transaction from the transaction listing for the account and review the payment details.

Alternatively, you may contact the Customer Relations (NZ) on 0800 38 48 58 or email customerassist@resimac.co.nz who should be able to assist you.

Important note, it may take up to 8-10 weeks for the resolution of a Pay Anyone dispute. This is because we will need to raise an ‘Mistaken Internet Payment’ (MIP) dispute on your behalf and work with external financial institutions in order to investigate the payment. -

How long will it take for someone to receive the funds I sent them via Pay Anyone?The time it takes for payees to see the funds in their bank account will vary depending on the policy and systems of the payee's bank/financial institution.

Generally, the payee should receive the funds within 24 to 48 hours. -

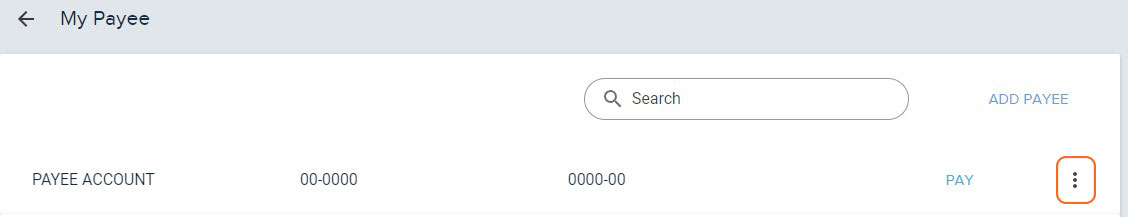

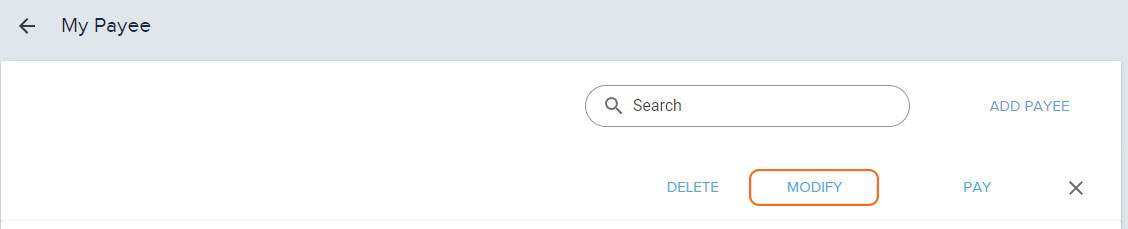

How do I manage my Payee list?

How to manage your Payee list

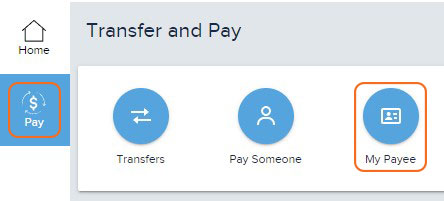

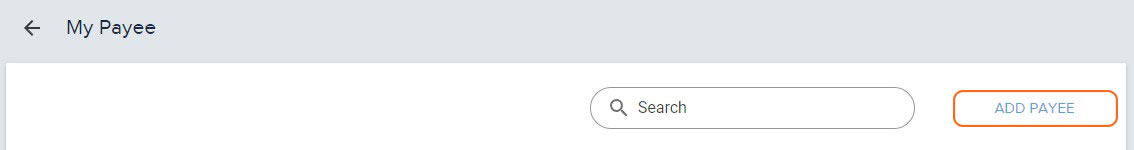

- Within CustomerZone, you can ‘add a new payee’, ‘modify’, or ‘delete’ saved payees from your payee address list. To do this, navigate to the ‘Pay’ menu and select ‘My Payee’.

Add a new payee

- You can add a new payee from the ‘My Payee’ page, then click on ‘Add Payee’ and enter the details for the new payee.

- You will need to enter the payee’s account number, account name and BSB. Once you have entered all the payee details, click ‘proceed’.

- You can also create a payee nickname to help you identify them for future transfers.

- You will be shown the details of the new Payee and asked to authorise, using a One Time Passcode, which will be sent to the registered mobile number.

- Enter the code you received. Once authorised, you will receive a confirmation that the new Payee has been successfully added.

Modify a payee

- Select the payee you wish to modify and click the 3 vertical dots

- Select modify

- Under Modify, you will be able to add or change the Nickname of the Payee.

- You cannot modify the payee’s account number, BSB details or the name on the account. You will need to create a new Payee.

Delete a payee

- You can delete a payee from your payee address list.

- You will need to enter the payee’s account number, account name and BSB. Once you have entered all the payee details, click ‘proceed’.

- If you have created a future or recurring payment for that payee, you won’t be able to delete them from the Payee address list until you cancel the future or recurring payments that have been set up.

- Within CustomerZone, you can ‘add a new payee’, ‘modify’, or ‘delete’ saved payees from your payee address list. To do this, navigate to the ‘Pay’ menu and select ‘My Payee’.

-

Can I make extra payments to my loan account?Within CustomerZone, you will be able to transfer between your accounts.

Alternatively, you can set up a payment from your external bank account to credit your Resimac loan account.

-

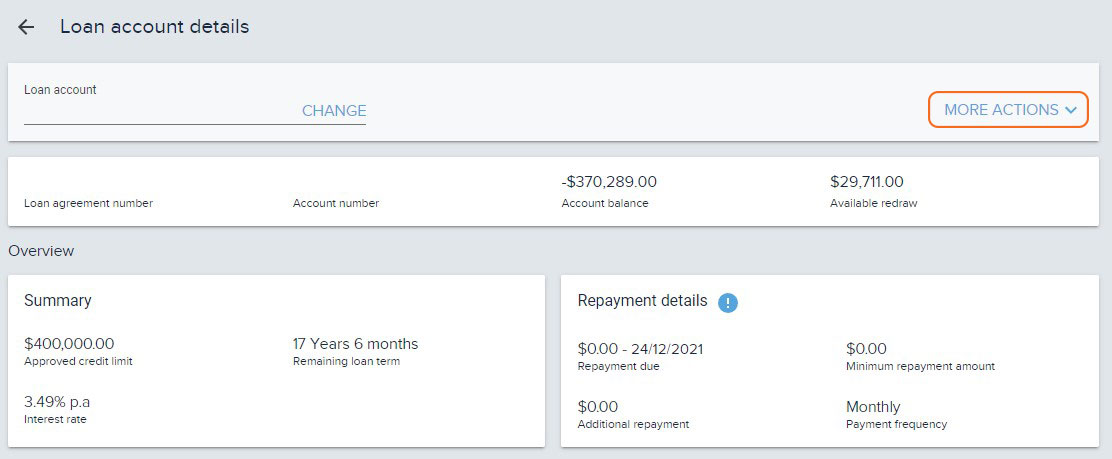

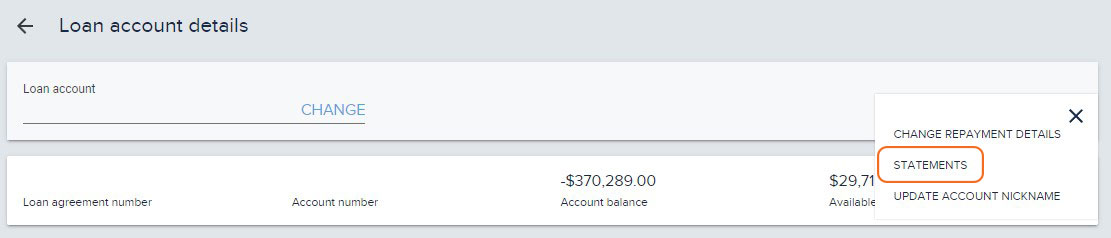

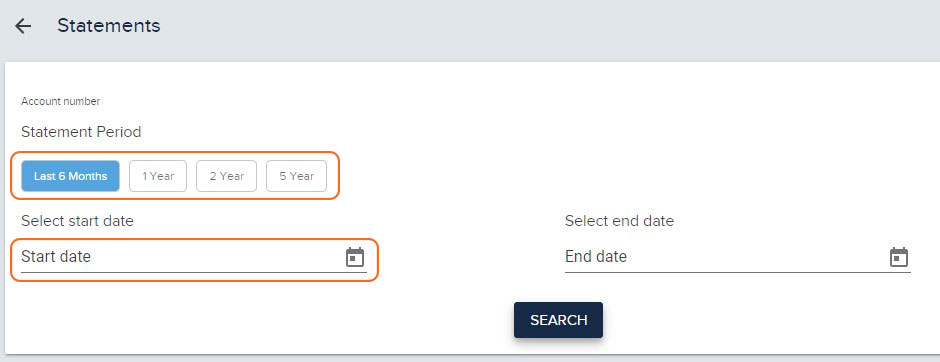

How do I obtain my statements?

How to get your statements

- You can obtain your online statement by selecting the ‘account’ and clicking on ‘More Actions’.

- From the dropdown list, select ‘Statements’

- Select the Statement Period and click ‘search’. Or you can also generate a statement from a ‘start date’ and ‘end date’.

- You can obtain your online statement by selecting the ‘account’ and clicking on ‘More Actions’.

-

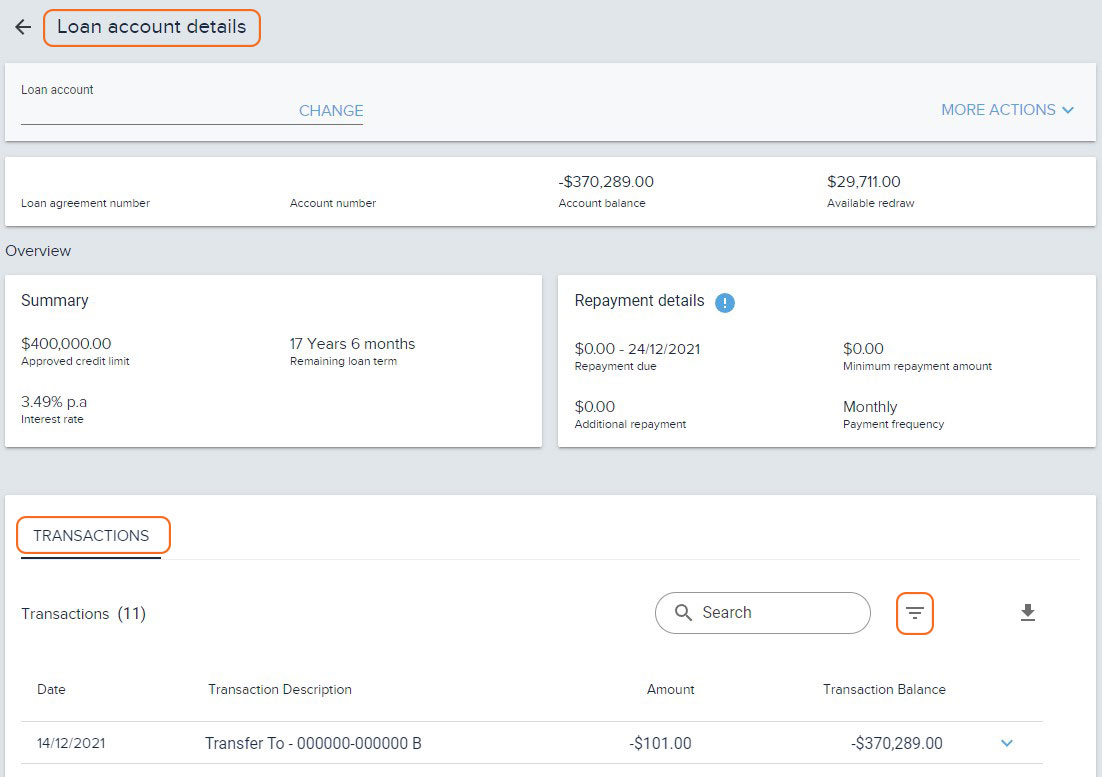

How can I view my transaction history of my account?

How to view your transaction history

- You can view your transaction listing from the ‘Loan account details’ under the heading ‘Transactions’.

- By clicking on the ‘filter icon’, you can use the filter and change the dates to view your transaction in the past 13 months.

- You can also download the transaction listing as a PDF or as an excel

- You can view your transaction listing from the ‘Loan account details’ under the heading ‘Transactions’.

-

Can I switch to e-statements in CustomerZone?To switch to e-statements you can contact the Customer Relations (NZ) on 0800 38 48 58 or email customerassist@resimac.co.nz who will be able to assist you.

-

Can I change my repayment frequency and amount?Yes, you can change your repayment frequency from weekly, fortnightly, or monthly for all Principal and Interest (P&I).

Note, if your account is Interest Only (IO) your repayments can only be monthly.

Please contact the Resimac Customer Relations team on 0800 38 48 58 or email customerassist@resimac.co.nz who will be able to assist you with changing your repayment frequency. -

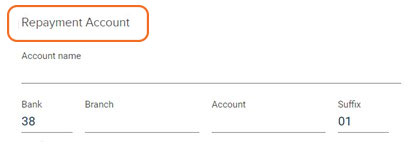

Where can I view and change my external nominated account details?

How to view and change my external nominated account details

- You can view your nominated repayment account details from the ‘Loan account details’ page, click on ‘more actions’, click on ‘Change Repayment Details’ under the heading ‘Repayment Account’.

- In order to change or update the nominated repayment account details, you will need to complete a Direct Debit form signed by all loan parties and email it to the Resimac Customer Relations team customerassist@resimac.co.nz who will verify and action your request. You cannot change or update the nominated repayment account details in CustomerZone.

- You can view your nominated repayment account details from the ‘Loan account details’ page, click on ‘more actions’, click on ‘Change Repayment Details’ under the heading ‘Repayment Account’.

-

Can I update my mobile number and email address in CustomerZone?No, you can’t. You will need to contact the Resimac Customer Relations team customerassist@resimac.co.nz who will verify you before updating your mobile number and email address.

-

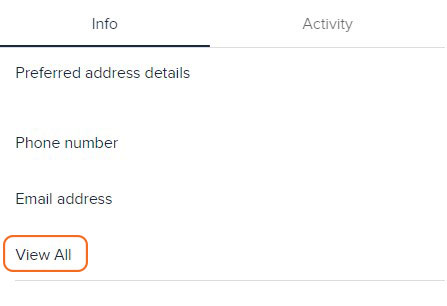

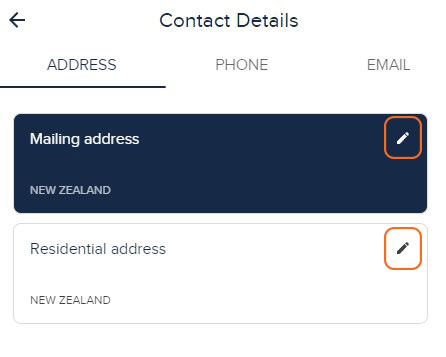

Can I update my address in CustomerZone?

How to update your address

- You can edit the profile icon

and click on ‘view all’

and click on ‘view all’

- You can edit your mailing address and residential address by clicking on the edit icon:

- You can edit the profile icon

-

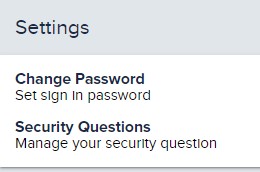

Can I change my password and secret questions?Yes, you can change your password and manage your security questions within ‘setting’.

Click on the cog icon to access the settings menu

to access the settings menu

-

What happens to my CustomerZone access when I fully discharge my loan?You will no longer have access to CustomerZone once you have fully discharged your loan.

-

Can I access my redraw and transfer between my accounts?

Yes you can access your available redraw and either transfer between your accounts or pay someone from the ‘Transfer and Pay’ screen:

Disclosure statement

-

How does the new redraw clause differ from the current redraw clause?The current Redraw clause 17.2 (d) within the Resimac Home Loans Limited General Terms reads:

- (d) the redraw amount does not result in the balance owing on your loan account exceeding your then current loan curve balance or, where relevant, the balance owing on the sub-account for a particular portion of the loan exceeding the current sub-account curve balance.

For the purpose of these redraw provisions, your "loan curve balance" is the amount that would be the balance owing on your loan account at that date if you had paid all scheduled repayment on time and not prepaid any amounts.

Where relevant, the "sub-account curve balance" is the amount that would be the balance owing on the sub-account for a particular portion if you had paid all schedule repayments on time and not prepaid any amounts.

If we agree to a request to change your repayment amount or require you to reduce the balance owing on your loan account or the balance owing on the sub-account for a particular portion, we also recalculate your loan or portion of if under a dynamic variable rate principal and interest option and your repayment amount for the loan or that portion is recalculated after you repay an amount early or redraw an amount, we do not recalculate your loan curve balance.

The changes made to the redraw clause 17.2 (d) has been amended to:- (d) where you have repaid part of the loan then you may redraw up to the amount that you have prepaid.

- (d) the redraw amount does not result in the balance owing on your loan account exceeding your then current loan curve balance or, where relevant, the balance owing on the sub-account for a particular portion of the loan exceeding the current sub-account curve balance.

-

How does the new redraw clause 17.2 (d) impact my loan?A simple example:

If you have a $400,000 principal and interest loan at a variable interest rate of 3.72%p.a. over 30 years, the monthly instalment is approximately $1,845.00 every month.

If you make additional payments totalling $50,000 you will have $50,000 that may be available as redraw and the outstanding balance of your loan will be $350,000.

Each month, the actual Interest charged to your loan is based on the outstanding balance of your loan.

In the current system:

The difference between the actual interest charged and the interest included in the instalment may be available to you as redraw.

In the new system:

The difference between the actual interest charged and the interest included as part of the instalment will be applied to reduce the amount that you owe, meaning you will pay down your loan faster, while still being able to redraw up to the amount of your additional payments.

If you are paying interest only then your repayments will be the actual amount of interest due on the outstanding balance.

Please note: Standard redraw terms and conditions apply. Redraw is unavailable on fixed rate loans. Please refer to your advisor for financial advice. -

Are my repayments changing when you move to the new system?No. Your repayments will not change just because we have moved to the new system. There is no change to the way we calculate monthly repayments and other frequencies will be using this same formula in the future.

Any change to your loan that alters the interest rate, term, credit limit, or payment frequency in the new system will use the same formula to calculate the minimum repayment amount for each repayment period.

Get in touch

We’re here to help. Simply leave your details here and we will get back to you.